Modelo 621 is the form used to pay Impuesto de transmisiones patrimoniales taxes when you buy a car in Spain. This tax can be paid online or at one of the major banks.

You complete the form online. If you can’t pay online then pay at a financial institution. You will need to print off three copies of the completed form.

The from will differ in design from one autonomous region to the next. Here we show you how to complete the version for the Junta de Andalucia.

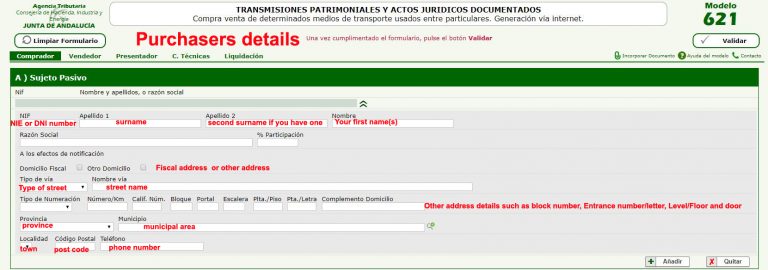

Section A. The top part of the form should be completed with the purchasers details.

Section B. This part of the form is almost identical and should contain the sellers details.

Section C. If you are dealing with the paperwork yourself then tick the check box in section C “El Presentador es también el primer Sujeto Pasivo”. If someone else is dealing with the paperwork for you then their details will go in here. Clearly if that is the case you won’t be filling in any of this form.

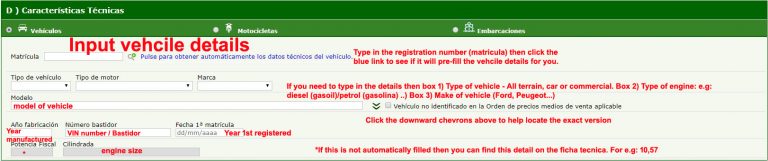

Section D. This is where the vehcile details go. Type in the registration number where it says “Matricula”. Then click the blue link to the right of it. The system will then search the details using the registration number and DNI/NIE of the owner and pre-fill the vehicle data. If it doesn’t then you can complete it manually. See the image above.

Section E. This is where the tax is calulated. If you know that your vehicle is exempt from taxes then mark the box “Sujeto sin Ingeso” and select “Exención”. In this case remember to complete the reason it is exempt.

In order to calculate the tax payable you need to refer to the values provided by the Ministry of Finance on an annual basis. You need to indicate the average sales value of the car and the percentage deduction. Here is the weblink for the Junta de Andalucia and here is a step by step guide on how to complete the online calculator.