Contents

Are Dash Cams Legal?

Dash Cams have become increasing popular over the years and are widely used in some countries.

Some people might want to use the Dash Cam to record their road trip. However, there is an increasing number of people who like the idea that the Dash Cam may help them in the event of a road accident.

The Dash Cam recording could help prove who was at fault in a road traffic accident. Without proof it is often one person’s word against the other. Without witnesses, police attendance or an incident that is clear cut, it sometimes leads to a frustrating outcome. Whilst it does not seem to be prolific in Spain, there are many social media videos out there where fraudsters step out in front of a vehicle in the hope of being able to make a claim against you and make some easy cash.

The question is though are Dash Cams Legal in Spain? Well, the short answer is yes, but you must be aware that Spain has some stringent Data Protection legislation. Please read the next section carefully.

Data Protection Law

The Data protection Laws in Spain prohibit the publication of photos and video of other people, without their express consent. Only the police and other emergency services are allowed to record images in public places. Unauthorised persons recording in public spaces could fall foul of the Agencia Española de Proteccion de Datos (AEPD) and receive a fine.

The images recorded by a Dash Cam can only be used for domestic use. If you were to publish them, for example on social media, then you would need the express consent of the people appearing in the images. Without it you would have to blur faces and disguise number plates and anything else that might lead to the people in the images being identifiable.

Recording images for your own use, a road trip record for example, is not illegal but continued recording could be considered surviellance and therefore fall under the Data Protection Laws in Spain. For example, if you left the camera on whilst the car was parked over night this could be considered video surveillance. Many banks, shops etcetera have a visible notice informing you that you are being recorded. These entities are registered with the AEPD and have to adhere to the Data protection Laws of Spain.

There was a story in the press last November of a man in A Coruña who left his Dash Cam recording the exterior to try and catch the person that was scratching his car. The police spotted the camera and the car was towed to the Municipal Compund. The owner of the car was hit with a 1,000 euro fine. The authorities concluded that the vehicle owner did not prove sufficient justification for the camera to be recording in a public place.

One of the issues is that under the Data protection laws in Spain people have a right to privacy. You cannot go round recording people indiscriminately. However, does the person who recorded the images on their Dash Cam have a legitiamte right to use those images as evidence, for example? This is a gray area and may boil down as to whether the recording is deemed to have met the prinicples of suitability and proportionality without violating the other parties rights under the data protection law.

Under the data protection law as it stands, an insurance company probably could not use the images directly but they could possibly be presented to a judicial court.

Installation

The installation of a DashCam in your vehicle is allowed but there are certain common sense rules that must be taken into account to ensure safe driving. The placement of the device should not interfere with your ability to drive the vehicle. The device should not obstruct your field of vision from the vehicle.

Using a Dash Cam

You must be careful not to manipulate your dash Cam whilst driving. The same as using your mobile phone whilst driving if you are switching on/off or using some other feature on your Dash cam whilst driving then you can be fined. The fine is 200 euros plus the loss of up to six points on your licence.

Will an insurance company accept the images or videos to help with an insurance claim?

With the data protection laws as they are in Spain it is currently unlikely that your insurance company will accept the video images recorded by a dashcam to assist with any insurance claim. This is because, as mentioned above, the recording of these images may breach the Data Protection laws in Spain. Use of these images could result in a fine for you and possible the insurance company.

Two of the issues here are:

1. The Data protection Laws in Spain prohibit the publication of photos and video of other people, without their express consent.

2. Continued recording could be considered surviellance and therefore fall under the Data Protection Laws in Spain. Instruction 1/2006 of the AEPD. If you are not registered then again you could fall foul of the law that is desgiend to protect people’s privacy.

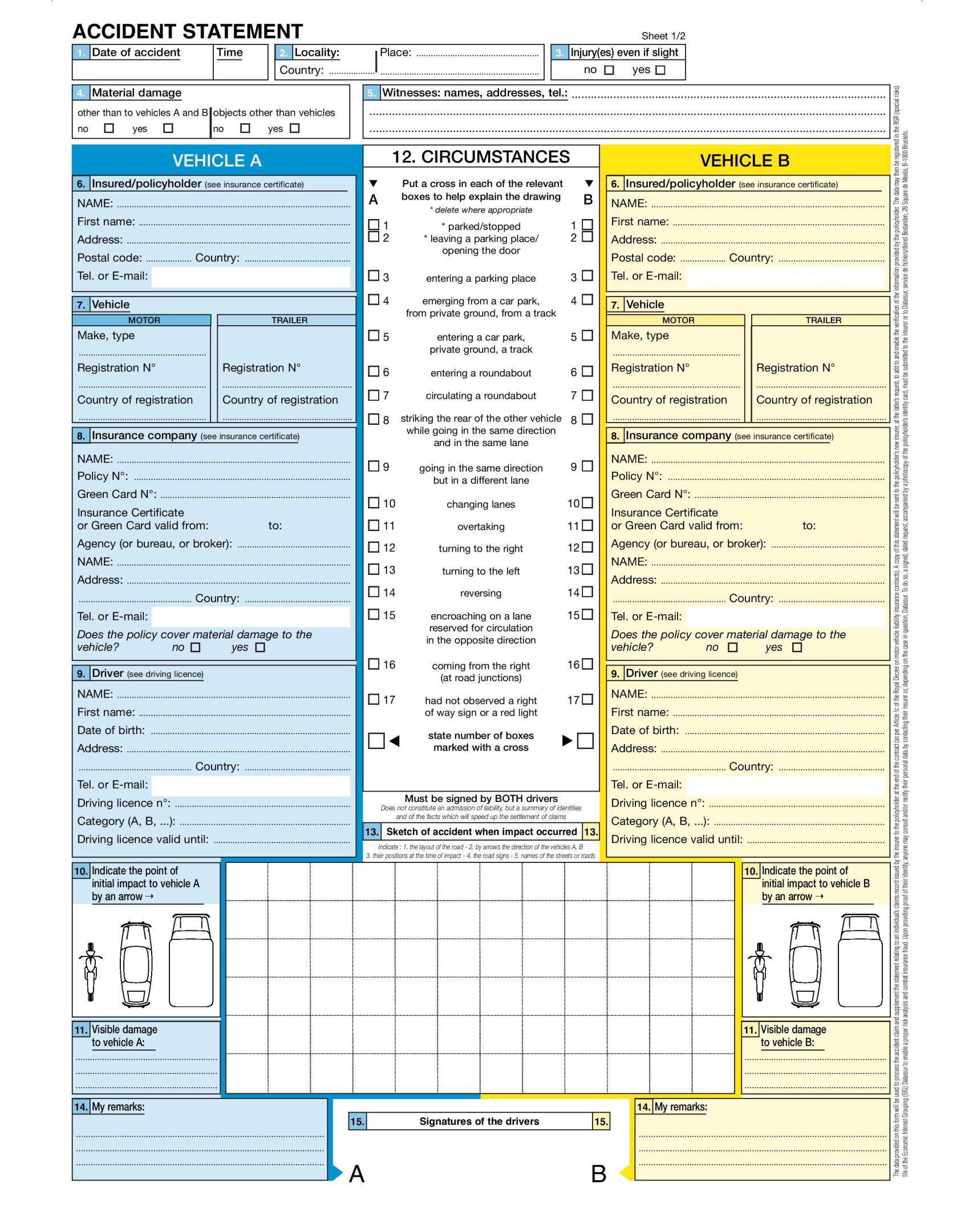

Taking photos after an accident to help show your insurance company the damage and position of vehicles is fine. However, they are unlikely to want to see the video of the incident recorded by a dash cam.

This article has been produced in good faith to provide some answers to general questions regarding the use of Dash cams. It does not constitute any form of legal advice. The laws and their interpretation can change over time.