The form modelo 620 is for the payment of taxes related to the transfer of ownership of a car in Spain among other things. As a purchaser of a vehicle it is your responsibility to present the form to the tax authorities.

The form needs to be submitted no later than 30 days from the purchase of the vehicle. Most banks accept payment of the tax. Once the tax has been paid you will need to present it with other documents to the tax agency (AEAT). See here the list of documents you need to present.

In some provinces you can present online. If so then complete modelo 621 online.

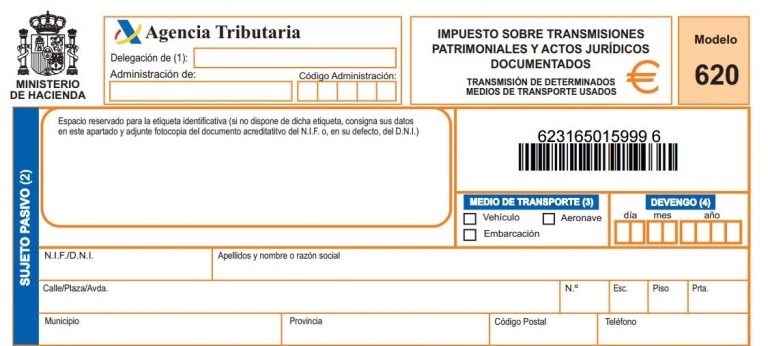

- At the top of the form is a box with the title Agencia Tributaria. In this box enter the delegation of the A.E.A.T or office of the Autonomous Community, as well as its code, in which the document is presented.

The form is then divided into sections down the left hand side and there are various numbers next to the headings throughout the form.

- Here you complete the details of the purchaser. NIF/DNI is where foreigners will need to enter their NIE number. The box to the right is where you enter your surname first followed by your first name or the name. Underneath where you have written your NIE number you put the street name (Calle/Plaza/Avda) . To the right of that you can enter further details to clarify your address including: street number, Entrance, Floor and door number. The final line of this section is where you fill in, the town,, province, post code and your telephone number.

- Here is where you indicate the type of transport the tax relates to. The form relates to vehicles, boats and planes. As we are only interested in vehicles tick the top box “vehículo”.

- Enter the date of acquisition of the vehicle. DD/MM/YYYY

Transmitente

- This section is almost identical to the part above. It is where you complete the details of the seller.

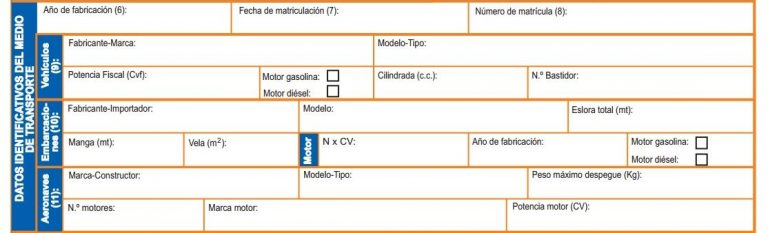

- Year of manufacture

- Type in the date of first registration

- Here you enter the registration number for the vehicle.

- This sub-section is where you enter more information about the vehicle. Make (Fabricante-Marca) and model (Modelo-Tipo). In the second line of this section you should record fiscal potential of the vehicle. This is a fiscal number and does not relate to the actual power of your vehicle. It is used to calculate the tax payable. You can find it on the ficha tecnica. It is recorded under number P.2.1. Next to potencia fiscal you need to indicate if your engine is petrol or diesel. Tick the appropriate box. The cilindrada (c.c.) is the engine size. If you are unsure you can again refer to the ficha tecnica of the vehicle. It is detailed under the reference number P.1. Finally you should enter the Bastidor number (VIN). This number appears on both the permiso de circulacion and the ficha tecnica under the letter “E”.

- Ignore as this relates to boats

- Ignore as this relates to planes

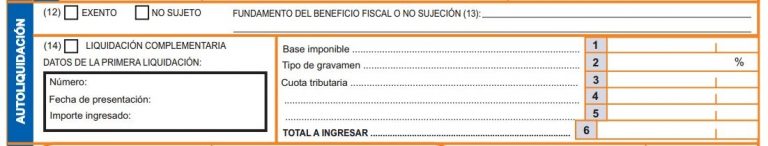

- If you know your vehicle is exempt or not subject to tax then you can indicate it by marking “Exento” or “No sujeto”.

- If you ticked on of the boxes in 12 then here is where you explain why you are exempt or not subjected to tax.

- Do not mark the box marked “Liquidacion complementaria”. We are only interested in the information in the middle and right part of this section.

To the right of the section numbered 14 is where you complete the details of the tax calculation. The first three lines relate to the figures used in the tax calculation. To calculate these three figures you need to use the correct tax calculator from the region you live in. For example, in Andalucia you can use this car transfer tax calculator. Careful, because different regions have different levels of tax so be sure to use an appropriate calculator. Here is a step by step guide to using the car tax calculator for Andalucia.

Once you have calculated the tax you will see the three figures you need to add to the document. (Example of the calculation below)

Having completed lines 1,2 and 3 repeat the figure from line 3 in line 6.

- Ignore this section if you are presenting the documents yourself. The person representing you completes this section.

Most banks accept payment of the tax. You will then need to present to document to the tax office before going to the Regional Traffic Office to complete the car transfer paperwork.